Over 2 million + professionals use CFI to learn accounting, financial analysis, modeling and more. Unlock the essentials of corporate finance with our free resources and get an exclusive sneak peek at the first chapter of each course. Start Free

An expansionary monetary policy is a type of macroeconomic monetary policy that aims to increase the rate of monetary expansion to stimulate the growth of a domestic economy. The economic growth must be supported by additional money supply. The money injection boosts consumer spending, as well as increases capital investments by businesses.

An expansionary monetary policy is generally undertaken by a central bank or a similar regulatory authority.

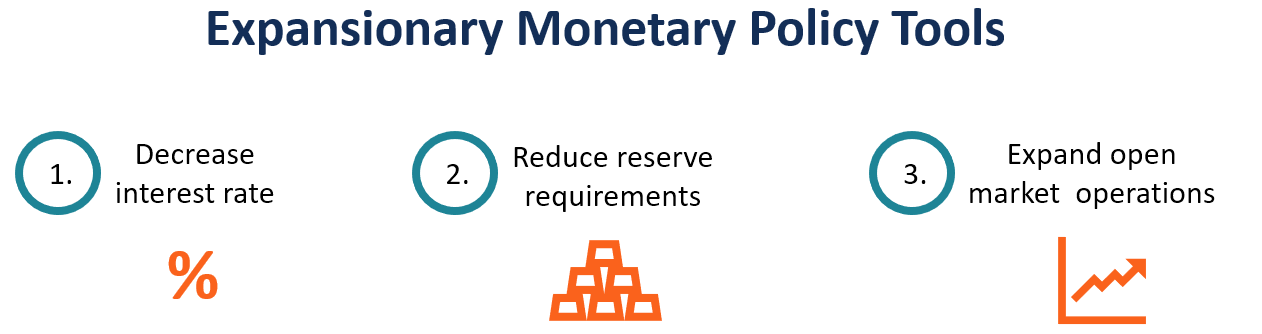

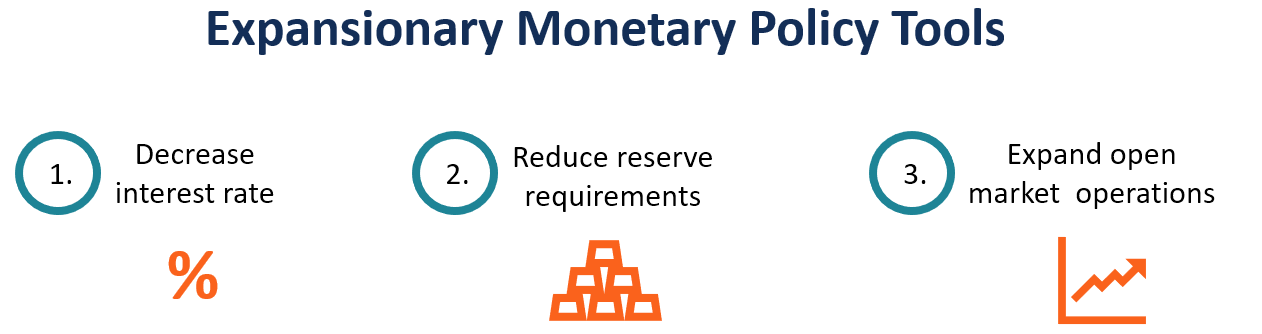

Similar to a contractionary monetary policy, an expansionary monetary policy is primarily implemented through interest rates, reserve requirements, and open market operations. The expansionary policy uses the tools in the following way:

Adjustments to short-term interest rates are the main monetary policy tool for a central bank. Commercial banks can usually take out short-term loans from the central bank to meet their liquidity shortages. In return for the loans, the central bank charges a short-term interest rate. By decreasing the short-term interest rates, the central bank reduces the cost of borrowing to commercial banks.

Subsequently, the banks lower the interest rates they charge their consumers for loans. Therefore, whenever the central bank lowers interest rates, the money supply in the economy increases.

Commercial banks are obliged to hold a minimum amount of reserves with a central bank. In order to increase the money supply, the central bank may reduce reserve requirements. In such a case, commercial banks would have extra funds to be lent out to their clients.

The central bank may also use open market operations with government-issued securities to affect the money supply in the economy. It may decide to buy large amounts of government-issued securities (e.g., government bonds) from institutional investors to inject additional cash into the domestic economy.

An expansionary monetary policy can bring some fundamental changes to the economy. The following effects are the most common:

An expansionary monetary policy reduces the cost of borrowing. Therefore, consumers tend to spend more while businesses are encouraged to make larger capital investments.

The injection of additional money into the economy increases inflation levels. It can be both advantageous and disadvantageous to the economy. The excessive increase in the money supply may result in unsustainable inflation levels. On the other hand, the inflation increase may prevent possible deflation, which can be more damaging than reasonable inflation.

The higher money supply reduces the value of the local currency. The devaluation is beneficial to the economy’s export ability because exports become cheaper and more attractive to foreign countries.

The stimulation of capital investments creates additional jobs in the economy. Therefore, an expansionary monetary policy generally reduces unemployment.

CFI is the official provider of the global Capital Markets & Securities Analyst (CMSA®) certification program, designed to help anyone become a world-class financial analyst. To keep advancing your career, the additional CFI resources below will be useful:

From equities, fixed income to derivatives, the CMSA certification bridges the gap from where you are now to where you want to be — a world-class capital markets analyst.